Tracie Kambie

Jan 26, 2026

Your eCommerce funnel wasn’t designed for a world where customers get answers without visiting your site.

If your growth model still assumes discovery starts with a click, you’re already mis-measuring what’s happening.

Right now, generative AI tools are stepping into the very top of your funnel. Not as a traffic source. Not as a channel you can neatly tag in GA. But as an answer layer that shapes what customers believe before they ever see your brand, your product pages, or your ads.

And that’s the part most teams are missing. What makes this shift especially dangerous is timing. Generative AI doesn’t break funnels all at once. It creates a lagging failure mode, where demand is reshaped upstream long before performance metrics show obvious decline. By the time traffic drops, conversion rates soften, or paid media efficiency degrades, the real damage has already been done. Fewer brands are even being considered.

This isn’t about “AI replacing SEO.” It’s about something more subtle, and more dangerous if ignored. Discovery, comparison, and shortlisting are collapsing into single AI-driven moments. That breaks the assumptions behind how eCommerce funnels have worked for the last decade.

In this article, you’ll learn:

• Where generative AI actually sits in the eCommerce funnel

• Why traditional SEO and attribution models fall apart at the top

• How AI-driven discovery reshapes awareness and consideration — even when there’s no click

• And how to think about measurement without lying to yourself (or your CFO)

This isn’t a hype piece. It’s a funnel reset — grounded in data, not opinions.

The eCommerce Funnel Was Built for Clicks and That’s the Problem

For the last decade, the eCommerce funnel has rested on one quiet assumption: discovery creates a click.

Generative AI breaks that flow.

That decision-shaping moment often happens without a click. Your analytics still assume awareness happens on your site. Your SEO reporting still assumes rankings drive sessions. Your attribution model still assumes influence starts when a user arrives. But AI-driven discovery doesn’t respect any of that.

Awareness and early consideration are no longer just traffic problems. They’re narrative problems. If your brand isn’t present in the answers customers see first, you’re not even in the race — even if your downstream conversion rates look healthy.

Where Generative AI Actually Sits in the eCommerce Funnel

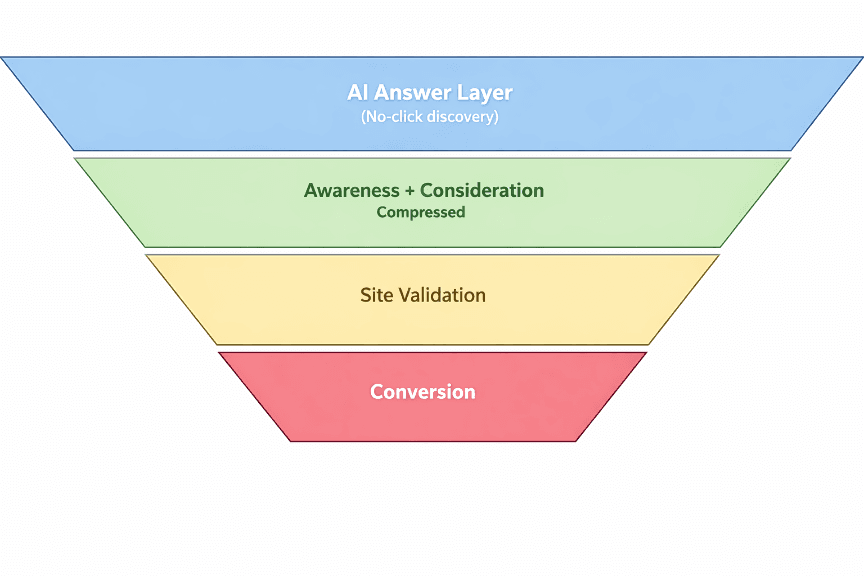

Generative AI compresses what used to be multiple steps into a single interaction.

By the time a shopper reaches your site, they’re no longer asking, “What are my options?” They’re asking, “Is this the brand I already trust?”

Stable traffic, healthy conversion rates, but slower growth. Generative AI isn’t stealing conversions. It’s influencing who makes it into your funnel in the first place.

Why Traditional SEO and Measurement Break at the Top of the Funnel

The biggest problem with generative AI isn’t visibility. It’s measurement. Generative AI snaps the chain of custody: impression → click → session → conversion.

Until teams adjust for that gap, they’ll keep optimising the visible middle of the funnel — while the invisible top quietly reshapes outcomes downstream.

This is why generative AI isn’t showing up as a crisis — it’s showing up as a misdiagnosis.

EXECUTIVE REALITY CHECK

If your dashboards show stable traffic, solid conversion rates, and predictable ROAS, it’s tempting to assume generative AI isn’t materially affecting your business — yet.

That assumption is exactly where the risk lies. Generative AI doesn’t remove demand. It filters it before your funnel ever sees it.

By the time traditional KPIs signal trouble, early consideration has already moved off-platform and your funnel is harvesting demand it no longer creates. The question for CMOs isn’t “Is AI driving conversions?” It’s “Are we still part of the demand that ever gets a chance to convert?”

How AI Compresses Awareness and Consideration and Why That Changes Growth

One question now does the work of five searches. If your brand isn’t named early, no amount of retargeting or CRO work can fix that.

Measurement That Matches the New Funnel

What This Actually Looks Like in Your Data (And Why Amazon Shows It First)

The hardest part about AI-driven discovery isn’t accepting the shift. It’s knowing how to see it while your dashboards still look healthy. This is where most CMOs get stuck.

If generative AI is shaping demand before your funnel begins, then traditional metrics are no longer leading indicators — they’re lagging confirmations.

So what do you measure instead? The answer isn’t a new channel report. It’s a new layer of visibility that sits above your funnel.

Here are the signals that reveal whether AI-driven discovery is helping or hurting your brand even when GA, Amazon Seller Central, and paid media dashboards still look stable.

AI Mention Rate (Category-Level Visibility)

What it shows:

This is the earliest indicator of whether your brand is even entering consideration. This is the percentage of AI responses in your category that mention your brand or product.Why it matters:

This is the new “share of shelf” in a world where the shelf is an answer.

If your brand is mentioned in 4% of AI responses and your top competitor appears in 22%, you are not competing for traffic — you are competing for existence. This is upstream of search volume, impressions, and clicks.AI Engine Share (Response Appearances)

What it shows:

This is the gate metric for growth in AI-mediated funnels. How often your brand appears in the final recommendations inside AI answers.Why it matters:

Most AI engines introduce only 2–4 brands per response.

If you are not in that set, how can you use experimentation to improve/ recover the lost demand.This metric explains why:

• Conversion rates stay strong

• But incremental growth slowsThe funnel isn’t broken. It’s being fed selectively.

Citation Sourcing (Where AI Pulls From)

What it shows:

This reveals which brands shape the narrative versus simply appear in it. Which pages, reviews, FAQs, and content sources AI models rely on when forming answers.Why it matters:

Two brands can be “mentioned” — but only one is trusted by the model.

AI doesn’t just name brands. It sources them.

Your citation footprint reveals whether your content is shaping the narrative — or being excluded from it.Brand vs Category Drift

What it shows:

This is the leading signal of share loss before traffic declines. Whether AI mentions your brand less frequently than it mentions your category peers.

Why it matters:

This exposes silent share loss that never appears in GA or Amazon reports.

If category visibility grows but your brand visibility shrinks, demand is moving — just not toward you.

Why Amazon Brands Feel This First

Amazon sellers are already living in a compressed funnel.

Shoppers don’t explore — they filter, scan, and shortlist instantly.

Generative AI does the same thing, only earlier.

That’s why Amazon brands often experience:

• Flat sessions

• Stable conversion rates

• Declining growth efficiency

The issue isn’t ranking. It’s pre-selection.

AI-driven discovery is now doing what Amazon’s search filters used to do — only before the customer ever reaches the marketplace. If your product isn’t introduced when customers define what “good” looks like, your PDP becomes a validation step, not a discovery surface.

How CMOs Should Think About Measurement and Action

The mistake most teams make is trying to measure generative AI like a channel. A better mental model: generative AI reshapes demand before it enters your funnel.

CASE STUDY

Consider a mid market DTC skincare brand competing in the crowded “sensitive skin moisturizer” category.

A few years ago, discovery in this space looked familiar. A prospective customer might search:

• best moisturizer for sensitive skin

• ceramide cream vs hyaluronic acid

• dermatologist recommended skincare brands

Each search created a new opportunity for brands to appear. Educational blog posts, comparison pages, paid ads, and retargeting all played a role in shaping awareness and consideration over time. Visibility accumulated across multiple touchpoints, and the funnel widened gradually.

Today, that same customer increasingly asks a single question inside an AI answer engine:

“What’s the best moisturizer for sensitive skin that won’t cause irritation?”

In one response, the system explains the category, defines what “safe” looks like (fragrance free, ceramides, barrier repair, minimal irritants), and produces a short list of brands. Two or three names are introduced as trustworthy by default. Others never appear.

Crucially, this happens before:

• Any SERP is shown

• Any blog is read

• Any brand site is visited

There is no browsing phase. No visible comparison shopping. No measurable discovery event. Now look at what happens downstream.

The brands that are named see traffic that looks perfectly healthy. Conversion rates are strong. New visitors arrive with high intent because the evaluation has already happened upstream. From inside analytics, everything appears to be working.

The brands that aren’t named don’t see a sudden traffic collapse. There’s no dramatic drop to trigger alarms. Instead, growth quietly flattens. Paid media efficiency stalls. Incremental spend produces diminishing returns. Repeat performance optimization fails to unlock the next layer of demand.

From a dashboard perspective, nothing is obviously broken.

Google Analytics doesn’t show a missing step. Paid search still converts. SEO rankings still look acceptable. But the pool of first time consideration has narrowed, and the funnel is now being fed selectively.

This is where traditional measurement fails.

The funnel didn’t stop working — it’s just no longer responsible for creating as much demand as it used to. It’s harvesting demand that was already shaped elsewhere. Brands don’t lose because their product pages fail to persuade; they lose because they were never introduced when customers decided what “good” even looks like.

That’s why AI driven discovery almost never shows up as a conversion problem. It shows up as a growth ceiling. Performance metrics stay clean while long term momentum erodes upstream.

Conclusion: The Funnel Didn’t Disappear — It Moved

The opportunity isn’t to “win AI search.”

It’s to measure and influence demand before it enters your funnel — before clicks, sessions, or PDP views ever exist. Because by the time customers reach your site or your Amazon listing, the most important decision has already been made : who is even worth considering.

Want To Know More? Book Time With An Expert